As digital transformation accelerates, businesses are moving away from cash and card-based payments in favor of faster, safer, and more flexible methods. QR code payment systems have emerged as a leading solution, simple to implement, low in cost, and highly effective. From small street vendors to large retail chains, adopting QR code payments isn’t just a smart move; it’s becoming essential. This article by GLODIPAY explores why businesses of all types should embrace QR code transactions and how doing so improves efficiency, security, and customer experience.

Understanding QR code payment systems

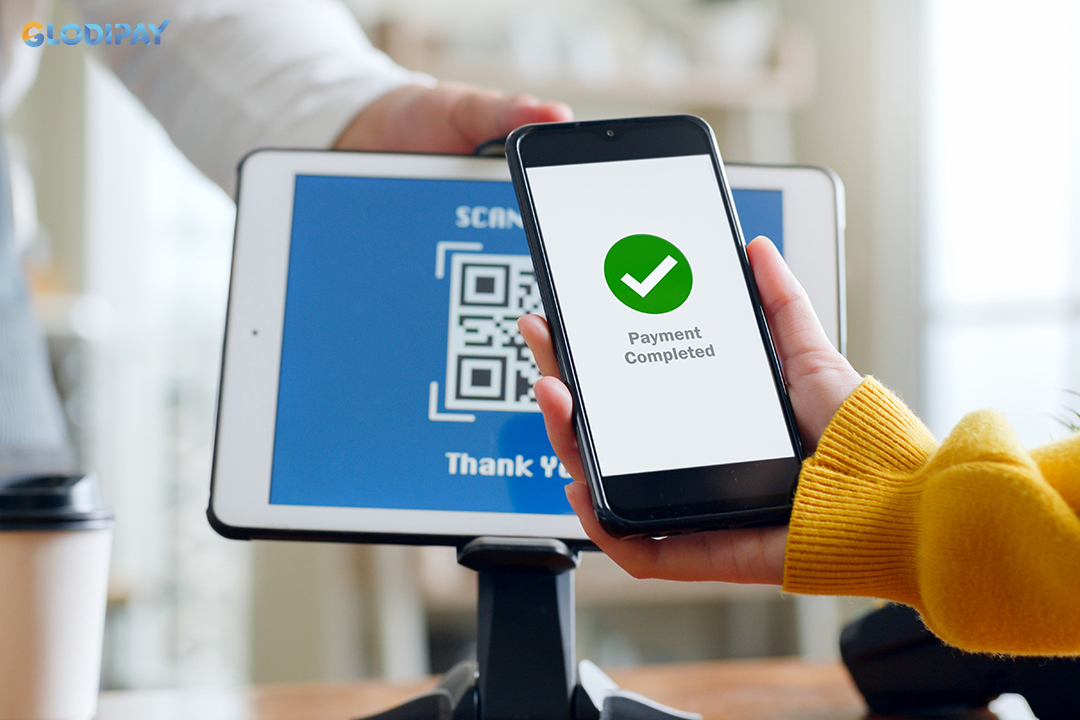

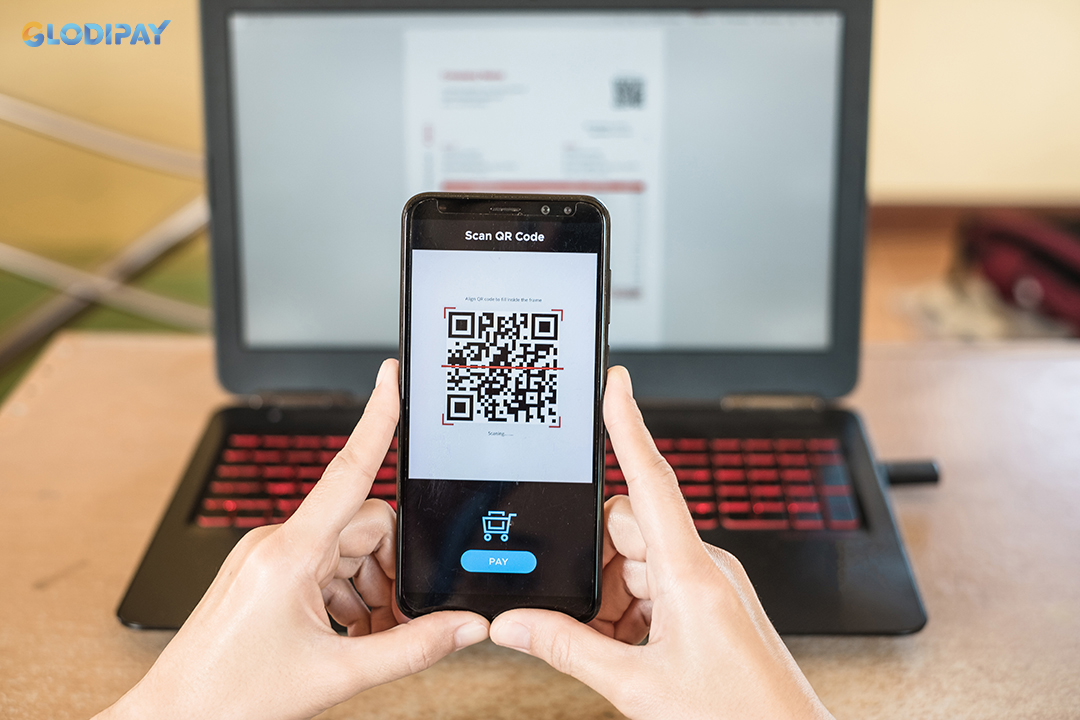

QR code payments are revolutionizing how businesses collect payments by offering a fast, secure, and contactless method of transaction. But how do they work, and why are they ideal for today’s retail landscape?

What is a QR code payment system?

A QR (Quick Response) code payment system allows customers to make payments by scanning a unique code using their smartphone. These systems work with digital wallets, UPI apps, or mobile banking platforms, enabling businesses to accept payments without physical cash or traditional card terminals.

How does it work?

- The business generates a unique QR code.

- The customer scans the code using their payment app.

- The payment is processed instantly and transferred directly to the business’s account.

This straightforward process eliminates the need for POS machines, making it an efficient, low-cost solution for all types of merchants.

QR code payments are revolutionizing how businesses collect payments by offering a fast, secure, and contactless method of transaction

Why businesses should adopt QR code payments

From reducing costs to enhancing customer convenience, the benefits of QR payments are clear. Here's why businesses, especially retailers, shop owners, and vendors, should make the switch.

Faster transactions and greater efficiency

Managing cash or swiping cards can slow down operations, especially during peak hours. QR code payments allow for instant transactions, cutting down wait times and increasing customer throughput. This is especially beneficial for busy retail environments and small shops with limited staff.

Improved customer experience

Today’s consumers expect speed, convenience, and contactless payment options. QR code systems cater to these expectations by enabling a seamless checkout process. Customers can pay using their preferred mobile wallet or banking app, no need to carry cash or wait for card approvals.

Secure and fraud-resistant transactions

Cash handling brings risks like theft, loss, and counterfeit notes. Card payments can be vulnerable to skimming or fraud. QR code payments, on the other hand, are encrypted and processed through secure digital channels, reducing the risk of transaction fraud and offering peace of mind for both businesses and customers.

Real-time settlements and simple payment tracking

Indiplex QR Code enables instant settlements, so businesses don’t have to wait for batch processing or bank clearance. This improves cash flow and makes bookkeeping easier. Every transaction is digitally logged, providing merchants with accurate, real-time records for better financial management.

QR code payment offers many benefits for businesses, especially retailers, shop owners, and vendors

How different business types benefit from QR payments

QR code payments aren’t just for large retailers. They serve businesses of all sizes across a range of industries.

Retail stores and supermarkets

For stores with high foot traffic, QR payments speed up checkout and reduce the need to handle change. Customers appreciate the convenience, and businesses benefit from improved operational flow.

Local shops and kirana stores

Neighborhood stores can easily implement QR code systems without any upfront investment. It also reduces reliance on small-denomination cash, which is often in short supply.

Street vendors and small merchants

Whether selling snacks, produce, or clothing, vendors can accept secure payments on the go. This reduces the risks associated with carrying cash and expands their customer base to those preferring digital wallets.

Freelancers and service providers

Professionals offering services, from home repairs to consulting, can use QR payments for instant, paperless transactions. Therefore, it is easier to manage payments and track earnings.

Different business types benefit from QR payments

Choose GLODIPAY - A payment gateway for multinational businesses

GLODIPAY is a modern global payment gateway designed to help businesses of all sizes streamline their payment processes. Supporting transactions in over 173 countries with their local currencies, it enables seamless acceptance of multiple payment methods, including credit cards, e-wallets, bank transfers, and QR code payments. With a user-friendly integration and localized checkout options, GLODIPAY allows businesses to offer customers a smooth and consistent payment experience, regardless of location or preferred method.

As QR code payments gain popularity for their speed, security, and convenience, GLODIPAY makes it easy for merchants to adopt this contactless option without the need for additional hardware. Businesses can generate and display unique QR codes for fast customer payments, both online and in-store. Combined with features like 3DS secure, instant settlement, real-time tracking, and advanced fraud prevention, GLODIPAY offers a reliable, scalable solution for today’s digitally driven commerce landscape.

GLODIPAY enables seamless acceptance of multiple payment methods, including credit cards, e-wallets, bank transfers, and QR code payments

QR code payments are a competitive necessity. For retailers, shopkeepers, service providers, and street vendors, adopting QR payments means faster transactions, enhanced security, better customer service, and lower operational costs. As the world moves toward a cashless future, businesses that embrace QR technology will be better equipped to grow, adapt, and meet the demands of today’s digital-first consumers. Now is the time to simplify your payment process, strengthen your financial operations, and modernize how you do business, with just one scan. Contact GLODIPAY today to adopt QR code payment as soon as possible.